Amazon.com Inc.’s (AMZN) stock was trading lower on May 1, by roughly 8% after reporting better than expected revenue, but missing earnings estimates. Additionally, the company issued revenue guidance that was in line with forecasts but warned rising costs would suppress operating income. Expectations of these rising costs may have already been getting built into the stock in recent weeks, with the technical chart flashing bearish warning signs.

The company has never been one to shy away from spending a lot to build for the future. Amazon has been able to successfully do this in recent years, helped by the explosive growth from Amazon’s web services (AWS). However, it also means that earnings estimates for the stock will need to fall.

Technical Warnings Signs Emerge

Even when heading into results, the stock saw a substantial region of selling around the $2,440 level. Since the middle of April, the stock was battling to rise at that price level and failed despite multiple attempts. It suggests that there is a great deal of selling pressure that resides at that level. Since reporting results, it seems the sellers have moved lower, and if the stock break support at $2,285, it could result in the shares falling to around $2,090, a decline of about 9% from its price of $2,290 on May 1.

But more concerning is that the stock is forming a bearish divergence noted by the lower highs in the relative strength index, as the equity was making record highs. It would suggest that momentum in Amazon is now shifting from bullish to bearish and that shares could have even further to fall then the initial 9%.

Fundamentals Shift

The technical trends appear to reflect the changes in the fundamental story. In recent years the stock had been viewed as a revenue growth story. However, as earnings have climbed, the investment thesis shifted from revenue growth to earnings growth. But investors might need to revisit this thesis over the short-term as earnings estimates fall and valuation rises. It will put more focus on the company’s ability to grow its revenue fast enough to satisfy investors’ demands.

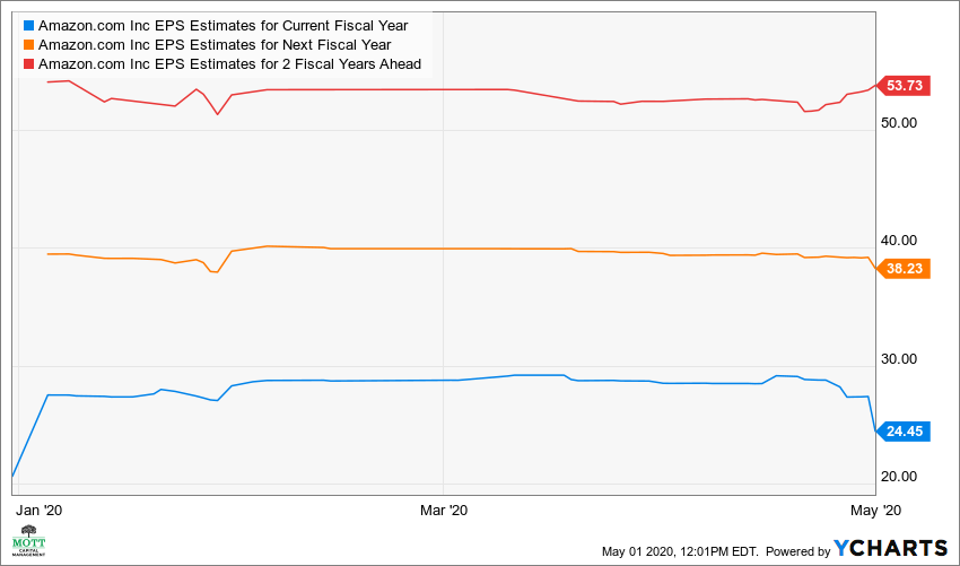

Analysts now see the company earning $24.45 per share in 2020, which is down from $27.38 on April 30. Meanwhile, earnings estimates for 2021 have declined to $38.23 per share from $39.16 per share. It leaves the stock trading for a one-year forward PE ratio of 58.6. This sounds high, but when adjusting for earnings growth in 2021 of 56.4%, it seems fairly reasonable. However, one must consider that earnings estimates may continue to decline, and that likely means that future growth rates contract and the PE ratios may rise.

AWS Drive Growth

The company reported revenue of $75.45 billion, which was about 1.8% higher than estimates for $74.15 billion. Meanwhile, earnings came in at $5.01 per share and missed estimates by about 19.8%. The company did see robust growth out of its AWS business unit, which rose by almost 33% to $10.2 billion while providing operating income of $3.075 billion. The AWS unit’s operating income accounted for nearly all of Amazon’s total operating income of $3.9 billion.

With the company back in spending mode, investors will need to recalibrate their expectations once again. It means refocusing emphasis on earnings growth to revenue growth and that a specific group of investors may decide to move on, rather than participate in a period of renewed spending.

Michael Kramer is a financial market strategist and the portfolio manager of the Mott Capital Thematic Growth Portfolio.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future